The potential to grow your business is limitless with transactions at per-item fees and an earnings credit to offset those fees.

Key Features

-

Tiered Interest

Tiered Interest

-

Earnings Credit

Earnings Credit

-

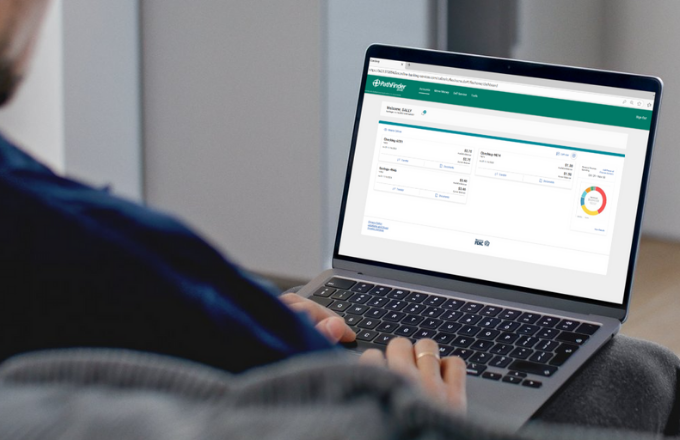

Free Digital Banking

Free Digital Banking

-

Free eRewards Debit Card

Free eRewards Debit Card

- Earnings credit based on collected balance1

- Tiered earnings credit yields greater credit on larger balances

- Credit applied to reduce or eliminate monthly fees, including:

- $15 monthly service fee

- 15¢ per deposit item

- 20¢ per check paid

- 50¢ per ACH transaction

- 50¢ per deposit ticket

- 15¢ per $100 cash deposited

- No minimum balance requirement

- Free Visa® debit card with valuable eRewards

- Free business digital banking

- Additional business services available

- $100 minimum deposit to open

1 Earnings credit will be calculated towards the reduction of service charges on your analyzed account. The earnings credit will be determined by the bank on the first day of each month, to be in effect for that month, and may change on the first day of any month. The earnings credit is set at the discretion of the bank. No index or rate is used to determine the earnings credit. All earnings credits calculated for the month may only be used in the month in which the earnings credit is earned, no carry over is allowed. Your collected balance will be reduced by a 10% reserve requirement prior to the calculation of the earnings credit. Refer to Rate Sheet for the earnings credit rates that apply to your account.